Ether ETFs Record Significant Outflows, Indicating Low Institutional Interest

Market Overview

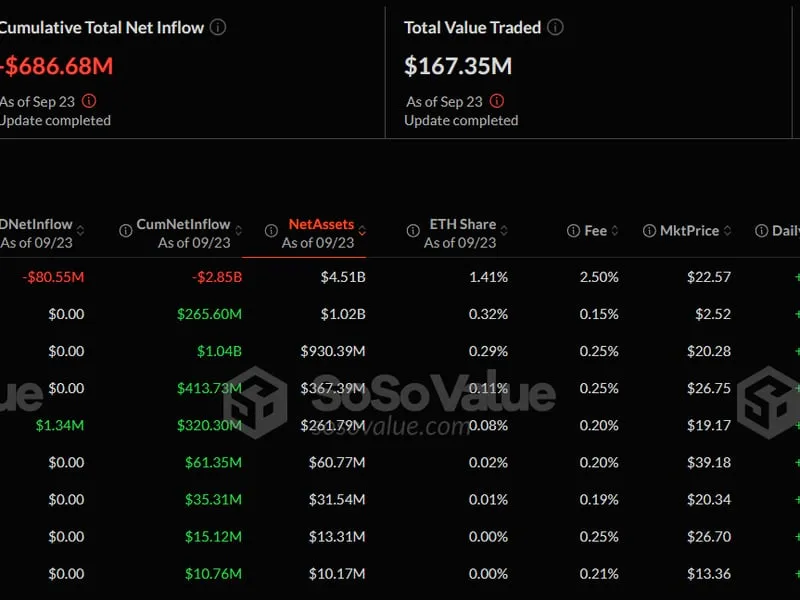

Ether ETFs have recorded the largest outflows since July, showcasing a concerning trend for the crypto market. On Monday alone, over $79 million departed from these funds, predominantly impacting Grayscale's offerings.

Reasons for Outflows

- Market Sentiment: Investor confidence in Ether has waned significantly.

- Regulatory Concerns: Ongoing regulatory questions may have affected institutional strategies.

- Investment Trends: A shift towards other cryptocurrencies is evident.

Implications for the Crypto Market

The data points to a possible shift in investment strategies as institutional interest appears to decline. Understanding these movements is crucial for future market predictions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.