Bitcoin Price Forecast Amid Federal Reserve Warnings from BlackRock

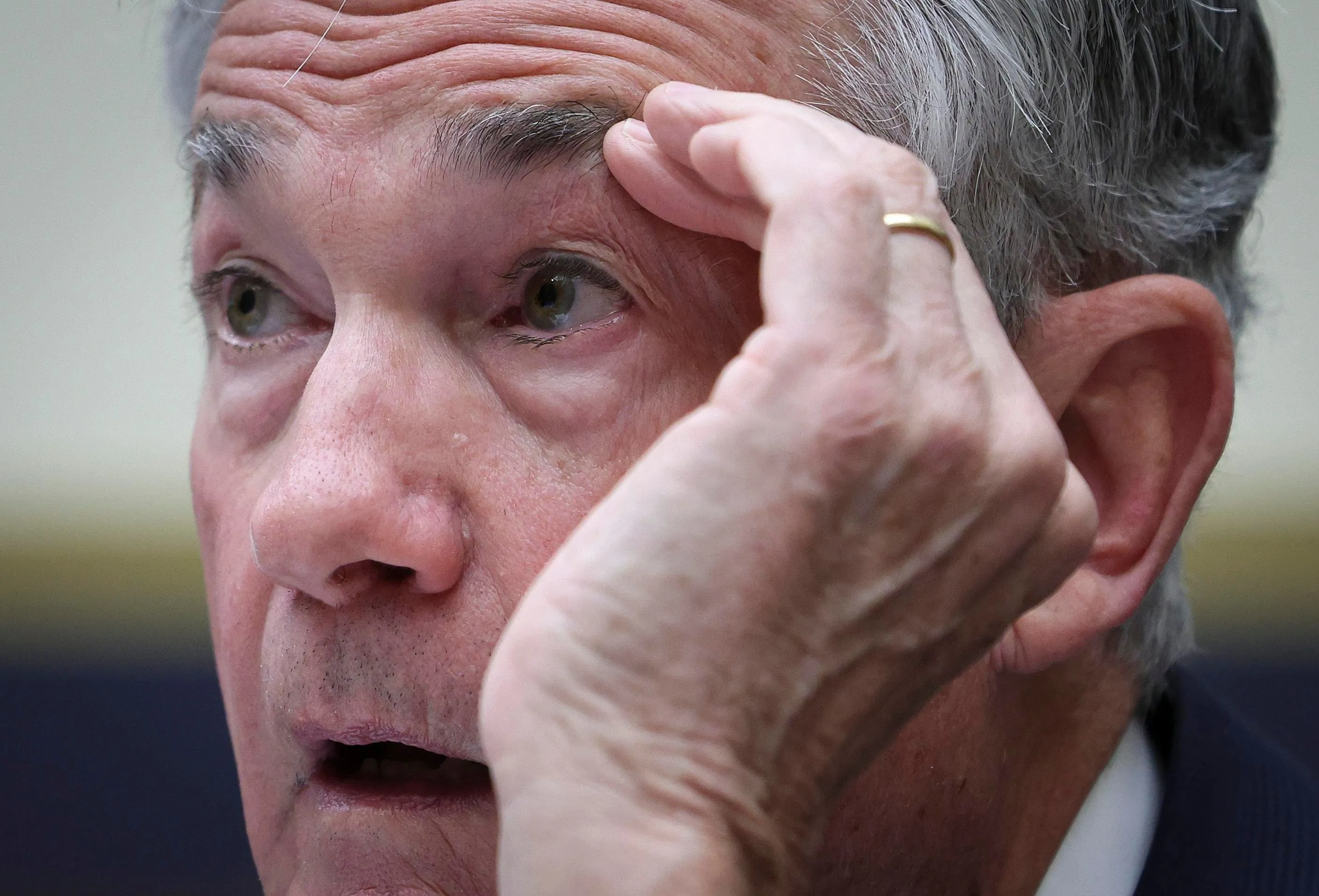

Understanding the Federal Reserve's Impact on Bitcoin

The recent warnings from the Federal Reserve regarding the growing $35 trillion U.S. debt have raised significant alarms. As highlighted by BlackRock, a major player in asset management, these concerns are expected to create a surge in Bitcoin interest.

BlackRock's Position

BlackRock noted that inflationary pressures and unstable economic conditions could redefine investment patterns. Institutions are increasingly viewing Bitcoin as a potential safe haven.

Predicted Bitcoin Price Boom

With the Federal Reserve's monetary policy and BlackRock's insights, predictions suggest a possible surge in Bitcoin price, driven by heightened crypto investment from institutions.

- BlackRock's observations can signal market shifts.

- Bitcoin could emerge as a hedge against inflation.

- Investor sentiment around crypto is changing rapidly.

Market Strategies Moving Forward

Investors should consider these developments when strategizing next steps in the crypto market. The implications of Fed policies will be crucial to watch.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.