How Fed Rate Decisions Influence Bitcoin Mining and Cryptocurrency Markets

As the Federal Reserve prepares for its next rate decision, bitcoin miners and the broader cryptocurrency markets are on edge. Whether the Fed opts for a 25 or a 50 basis point rate cut, the consequences could be significant for the financial performance of numerous mining companies, including Core Scientific Inc. and Terawulf Inc.. This decision could not only impact the share price movement of these diversified holding companies but could also signal shifts in market dynamics.

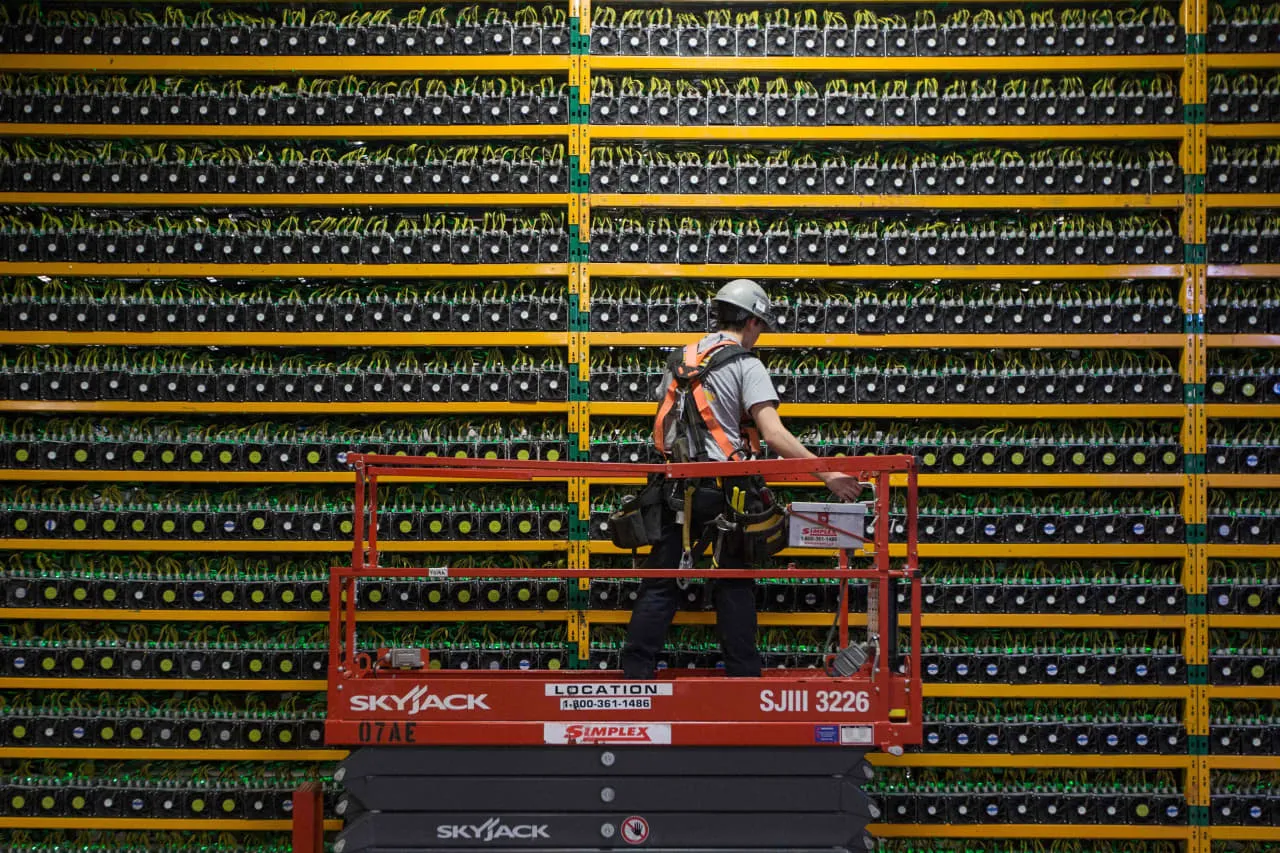

Implications of Fed's Rate Cut on Bitcoin Miners

The anticipated rate adjustments by the Fed have potential implications for bitcoin mining profitability and operational sustainability. Market analysts believe that favorable rates may provide relief to struggling firms facing mounting pressures from increased energy costs and fluctuating demand for virtual currencies.

Key Players in Bitcoin Mining Services

- Core Scientific Inc. (CORZ)

- Terawulf Inc. (WULF)

- Hut 8 Corp. (HUT)

- Riot Platforms Inc. (RIOT)

- MARA Holdings Inc. (MARA)

Effects on Cryptocurrency Markets

Beyond the immediate impact on mining companies, a Fed rate cut could trigger broader movements in cryptocurrency markets. Volatility may increase as traders react to monetary policy shifts, potentially influencing foreign exchange markets and commodity prices as well.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.