MicroStrategy's New $700M Note Issuance for Bitcoin Expansion

MicroStrategy's Strategic Move to Boost Bitcoin Holdings

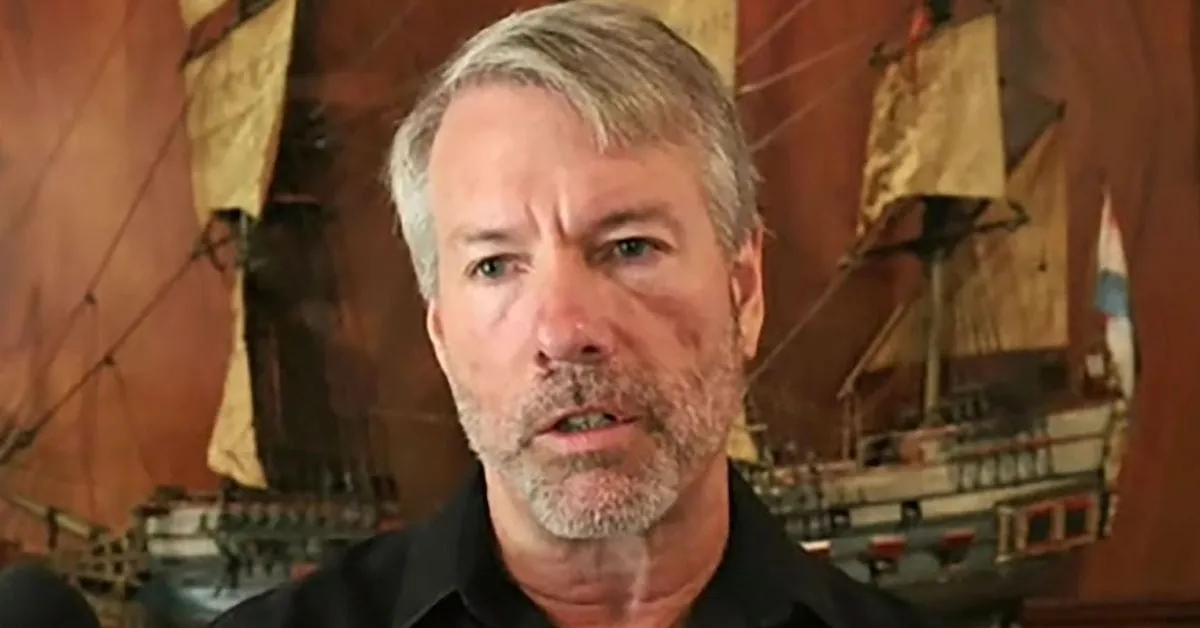

MicroStrategy, led by Michael Saylor, is poised to issue $700 million in convertible notes as part of its expansive strategy to acquire Bitcoin. This initiative underscores MicroStrategy's commitment to accumulating Bitcoin, aiming to increase its already formidable treasury of 244,800 BTC, valued over $14 billion.

The Significance of Saylor's Strategy

- Leadership in BTC Holdings: With these new funds, Saylor is reinforcing MicroStrategy's position as a pivotal player in the corporate Bitcoin landscape.

- Market Influence: Such a financial maneuver is expected to impact Bitcoin market sentiment positively.

Implications for the Future

The implications of this convertible note issuance are significant, potentially offering investment opportunities that resonate with both institutional and individual investors. Saylor’s ongoing vision for Bitcoin could redefine corporate engagement within the cryptocurrency space.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.