Trending: The Rise of Real World Assets in Blockchain Markets

The Surge of Real World Assets

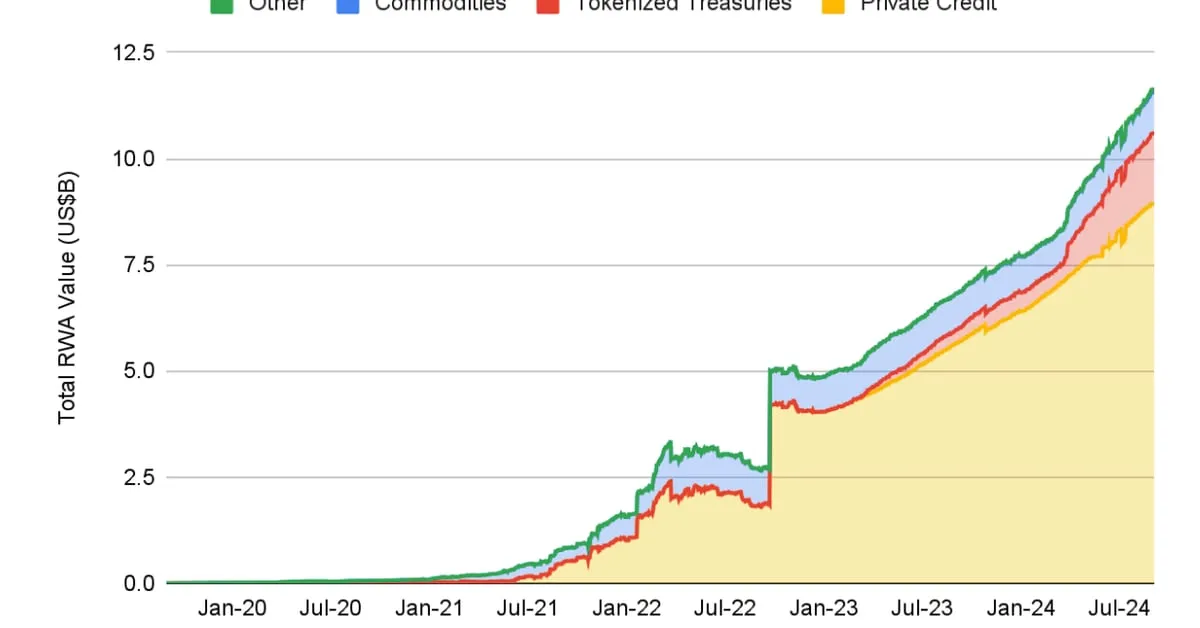

Recently, the tokenized market for real world assets has hit a stunning valuation of over $12 billion. This explosive growth shows the increasing interest in utilizing blockchain technology to represent tangible assets like U.S. Treasuries.

Impact on Markets

This trend signifies a pivotal change in markets as businesses and investors harness blockchain to enhance liquidity and accessibility of assets. The integration of real world assets into the crypto space is not just reshaping transactions but also creating new investment opportunities across various sectors.

- Increased interest in tokenized assets

- Growth in regulatory frameworks

- Innovations in asset management

What Lies Ahead

As the blockchain technology continues to expand, the future looks promising for real world assets. Investors and businesses are keen to explore its potential for revolutionizing traditional practices and improving market efficiency.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.